Depreciation percentage formula

Total Depreciation Expense 2 Straight Line Depreciation Percentage Book Value Relevance and Uses of Depreciation Expenses Formula. This tax depreciation method uses the straight-line formula under the GDS that calculates an even depreciation amount over the assets life.

How To Calculate The Depreciation Of Currency Accounting Education

Then after multiplying that by 100 to get a percentage youre all set.

. If you use this method you must enter a fixed yearly percentage. Figure out the assets accumulated depreciation at the end of the last reporting period. On 1 January 2016 XYZ Limited purchased a truck for 75000.

Amortization and depreciation are two methods of calculating the value for business assets over time. Accumulated depreciation is the cumulative depreciation of an asset up to a single point in its life. The management of Wayne Inc.

Heres the formula for percentage increase. Luckily the formula for calculating percentage change isnt very complex. Next you divide the increase or decrease by the first initial value.

Which multiplies the basis dollar amount by the appropriate depreciation percentage. Depreciation cost - salvage value years of useful life. GDS using straight-line method.

The following formula calculates depreciation amounts. In the straight-line method the depreciation amount is a constant percentage of the basis equal to d1n. Finally the formula for depreciation can be derived by dividing the difference between the asset cost step 1 and the accumulated depreciation step 8 by the useful life of the asset step 3 which is then multiplied by 2 as shown below.

Calculating Depreciation Using the 150 Percent Method. Depreciation Expense is very useful in finding the use of assets each accounting period to stakeholders. Yearly depreciation to be booked under Statement of Profit Loss will be 10000 x 10 1000 annum.

X Number of Depreciation Days x Depr. Tax benefits also take place in depreciation. This accelerated depreciation method allocates the largest portion of the cost of an asset to the early years of its useful lifetime.

The boolean value TRUE as the last argument tells the. Diminishing balance or Written down value or Reducing balance Method. First find the difference between the two values you want to compare.

The declining balance method is a widely used form of accelerated depreciation in which some percentage of straight line depreciation rate is used. Use the following formula to calculate depreciation under the reducing balance method. On the income statement it represents non-cash expense.

The MACRS is set up to fully depreciate the asset down to 0 - it doesnt take into account a salvage value. The basis for depreciation of MACRS property is the propertys cost or other basis multiplied by the percentage of businessinvestment use Quoted from pub 946. Depreciation rate is the percentage decline in the assets value.

Written Down Value Method Example 2. The VDB variable declining balance function is a more general depreciation formula that can be used for switching to straight-line see below. Under this method we charge a fixed percentage of depreciation on the reducing balance of the asset.

In other words the total number of sales dollars that. Basis 100. This formula can be presented as follows.

In addition Wayne Inc. Depreciation fracCost of asset Residual valueUseful life Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100. Purchased office furniture like tables and chairs worth 10000.

The depreciation rate that is determined under such an approach is known as declining. Guide to Profit Percentage Formula. This figure is then divided by your starting weight and the resulting number is multiplied by 100.

The following formula calculates the depreciation rate for year j. This will give you your weight loss percentage. Amortization is the practice of spreading an intangible assets cost over that assets useful.

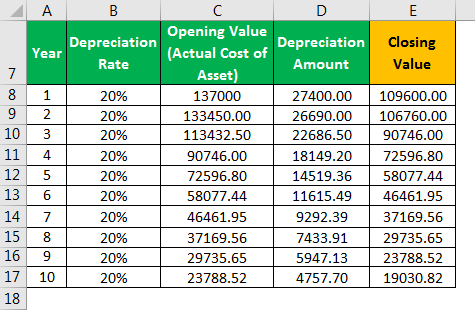

The straight-line depreciation formula is. Depreciation is estimated at 20 per year on the book value. The margin of safety formula is calculated by subtracting the break-even sales from the budgeted or projected sales.

This formula shows the total number of sales above the breakeven point. Here we discuss the calculation of profit percentage formula along with examples and downloadable excel template. The 150 percent depreciation is found by dividing the straight-line depreciation percentage by 15 150 percent to find the percentage per year.

An assets carrying value on the balance sheet is the difference between its purchase price. A usual practice is to apply a 200 or 150 of the straight line rate to calculate and apply depreciation expense for the period. For a useful life of 5 years.

Not included in annual revenues amounted to 2300 million. Depreciation Amount Declining-Bal. Charges a yearly depreciation of 800 million on its assets.

Calculating Depreciation Under Reducing Balance Method. To calculate your weight loss percentage your current weight is subtracted from the weight you were at when you first began your efforts to lose weight.

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Formula And Excel Calculator

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Asset Calculator

Repeated Percentages Basic Depreciation Grade 5 Onmaths Gcse Maths Revision Youtube

Depreciation Formula Calculate Depreciation Expense

Declining Balance Depreciation Double Entry Bookkeeping

Accumulated Depreciation Definition Formula Calculation

Depreciation Calculation

Depreciation Formula Calculate Depreciation Expense

Depreciation Of Assets 1 Of 3 Flat Rate Depreciation Youtube

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Examples With Excel Template